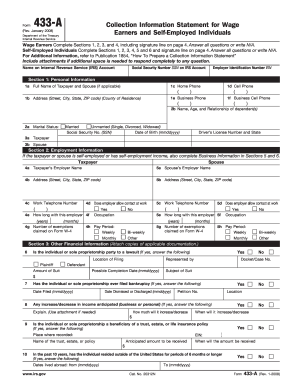

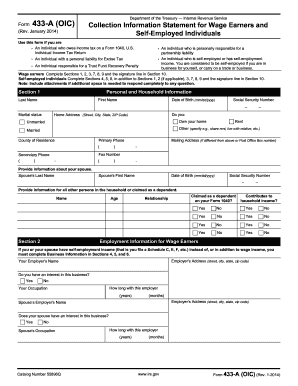

Get the free ftb form 4107

Get, Create, Make and Sign

Editing ftb form 4107 online

How to fill out ftb form 4107

How to fill out ftb form 4107:

Who needs ftb form 4107:

Video instructions and help with filling out and completing ftb form 4107

Instructions and Help about ftb form 4107

So ladybug on me, I haven't done any video inside the bus and my woodpile tipped over with all the rain we've had like three inches of rain in the last week some race tech than that but thought I'd just take five minutes here and shoot a quick inside video because people have asked, but this is actually a project for tomorrow, so you can see the kink in this door the bus sat with the door open and that's what all this water damage hair is about but when it did and the bus sank into the ground bottom of the door touched the ground before the bus was finished settling and loaded up the door pretty good the hinge seems okay the front side is straight, so I mean this gap here looks pretty good I think it's just the door spent, so I'm going to take a few minutes, and I'm not going to try to get it perfect I'm going to take this piece of loan off here that the previous owner put on see if I can straighten that a little I really just want to get it so that it'll close and latch kind of is for the winter but here we go Music number six 68 and the driver stationed here first look it's terrifying but pretty nice shape I have no idea I know that there gauge works I'd love it if I could get that original speed working, but I'm really going to try to maintain the integrity of this — section I'm going to add some gauges, and I'm not sure where that's going to end up being but somewhere Music this of course is the original wiring be going that through that completely just none of this will survive so getting rid all that I'm going to build a new moon for the bus plywood underneath here pretty rough buses leaked some majority the corrosion damage that I've like these obvious is around this window here at the bottom rusty and then same deal over here, and I don't know if this is common to the Buffaloes there's a crack here looks weldable, but I'm definitely going to have to fab up some sheet metal when it comes to this see outside here it's a little crusty and rusty in there all these window gaskets are pretty toast, but you can kind of see what's going on their ladybugs have moved in that's probably going to be an issue, so we took a few things out of the bus actually the owner's son took a couple items out of the bus when we got it, but there's a lot of but otherwise everything that I show you when I turn around was in the bus so here we go this is how I got it found it slash got it the guy I bought it from actually did the conversion well I bought it from his son he the actual owner was living in North Carolina got in New York this window here took some sort of impact and is broken which really sucks these gaskets are all shrunk also not fun I don't I haven't started sourcing this stuff, yet I'm just crossing my fingers and hoping we can get it a lot of this stuff I haven't even opened plenty of rodents and fun spiders and Music this is just an as is video just so you can kind of see what I saw some lovely mattresses I don't know if this original step...

Fill form : Try Risk Free

People Also Ask about ftb form 4107

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your ftb form 4107 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.